Welcoming our friends from The David Lin Report.

This is our latest newsletter alongside Gold related clips from TDLR.

STLLR News

Email Subscription

Subscribe to STLLR new releases and newsletter for regular updates and information

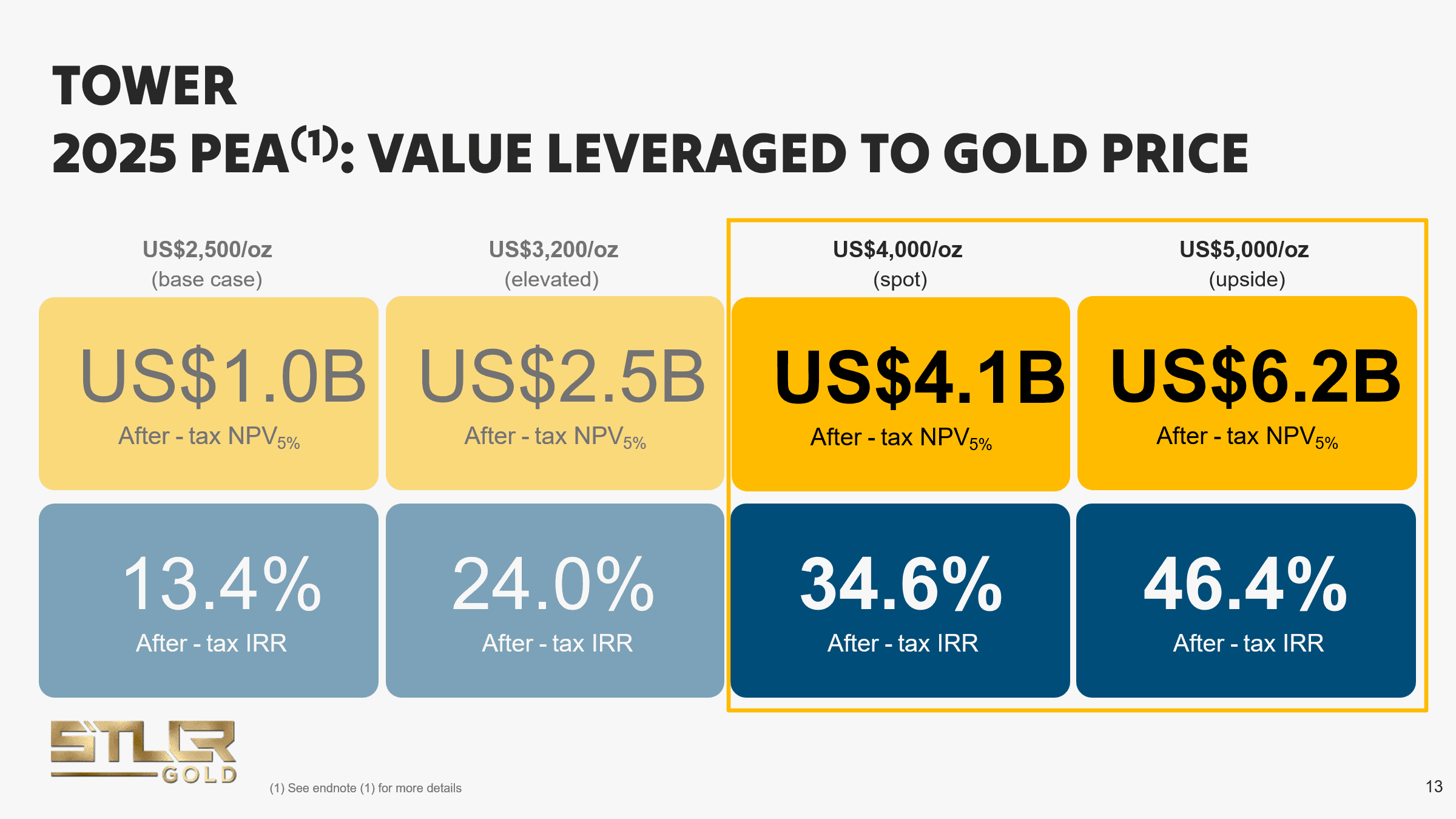

2025 PEA HIGHLIGHTS

TOWER GOLD PROJECT

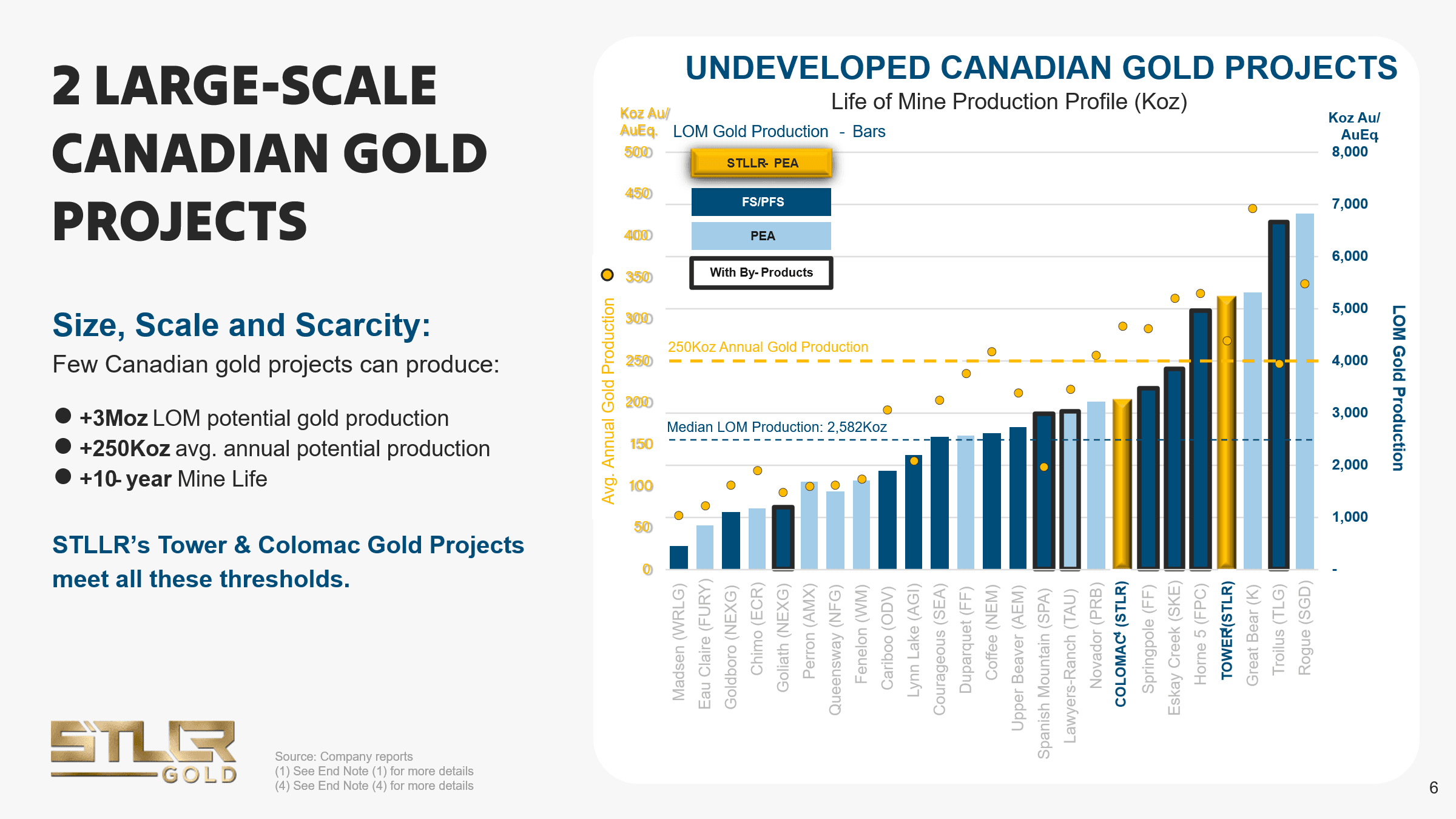

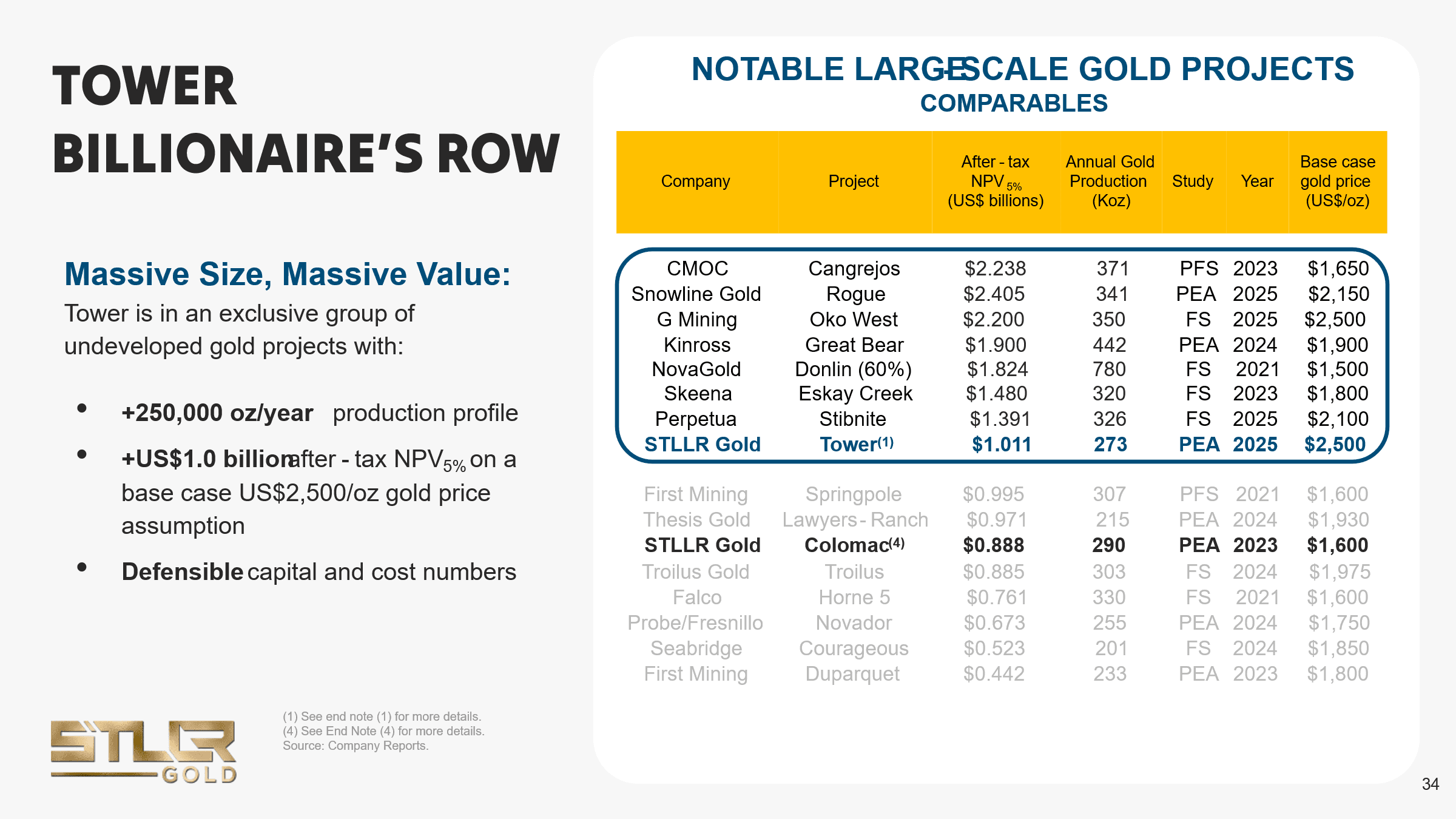

STLLR's flagship asset in the renowned Timmins Mining Camp and one of the largest undeveloped gold projects in Canada. |

ARTICLES

Gold Commentary

Gold Market

January 2026 was one of the most historic and volatile months in gold markets. Gold began the month in a strong uptrend following record‑breaking rallies in late 2025, trading around $4,300–$4,400/oz in the first week of January.

By mid‑month, gold surged to an all‑time high, breaking above $5,000/oz, with intraday peaks near $5,110–$5,600/oz between January 23 and January 29 — driven by strong safe‑haven flows, geopolitical tension, and heightened uncertainty around monetary policy.

However, late January saw a sharp reversal and significant correction. Toward month‑end, gold prices pulled back sharply from record highs, declining more than 10% in very short timeframes as markets repriced expectations around Federal Reserve policy following the nomination of a more hawkish Fed chair and technical over‑extension.

The closing price on January 31 was around ~$4,865/oz, reflecting a net monthly gain of about +12.4%, despite the extreme intramonth swings between peak and trough.

Influencing Factors

Safe‑Haven Demand & Geopolitical Risk

Geopolitical tension and global uncertainty, especially in early January, drove large flows into gold as a shelter asset. Safe‑haven demand was a dominant driver of the sharp rally above $5,000/oz.

Monetary Policy Expectations

Markets had been pricing in aggressive rate cuts in 2026 — supportive for gold — but the nomination of Kevin Warsh as Fed Chair later in January triggered a rapid reassessment of rate expectations. This recalibration toward a potentially less dovish Fed sparked a strong pullback in gold prices.

Technical Over‑Extension

After a historic rally, gold entered overbought territory, making any violent reversal or profit‑taking highly likely. The late‑month weakness reflected this technical fatigue combined with macro newsflow.

ETF & Institutional Demand

Global gold ETFs continued to attract significant inflows — reportedly setting new records for holdings and trading volumes — reflecting persistent investor demand even amid volatility.

Retail & Behavioral Factors

Retail investor interest surged, with some narrative forecasts floating extreme long‑run valuations based on monetary stress and reserve dynamics — although such forecasts are speculative and not consensus views.

Technical Analysis

Price Range & Key Levels

Early January Range: ~$4,300–$4,400/oz at the start of the month.

New Highs: Gold pierced $5,000/oz, with intraday highs between $5,100‑$5,600/oz.

Late January Correction: Prices retreated toward $4,700‑$4,900/oz after the sharp sell‑off near month’s end.

Trend & Momentum Indicators

The initial part of January demonstrated strong bullish momentum, with consecutive higher highs and heavy upside volume supporting a dramatic rally.

Momentum became overstretched by mid‑to‑late January, as technical indicators likely entered extreme overbought conditions. The sharp reversal late in the month reflected a loss of short‑term bullish momentum and a shift to short‑term consolidation/correction.

Breakout Attempts

The break above $5,000/oz was the defining breakout — a milestone psychologically and technically.

However, failure to sustain above the extreme highs and the rapid sell‑off around major resistance demonstrated that the breakout was likely an exhaustion move rather than the start of a sustained new price base above $5,600.

Volatility & Consolidation

January was characterised by exceptionally high volatility — perhaps among the highest in recent memory for precious metals — with large intraday swings and sharp reversals.

After peaking, gold entered a consolidation and corrective phase, where prices settled into a range below the extremes, reflecting risk‑off repositioning and regular profit‑taking following the extended rally.

Conclusion

January 2026 was a breakout and correction month for gold. The metal began with strong technical momentum carried over from 2025 and extended gains into record territory above $5,000/oz driven by safe‑haven demand, weak real yields, and geopolitical fears. However, a sharp late‑month reversal tied to shifts in monetary policy expectations and technical overextension led to a steep retracement. Despite this correction, gold finished the month significantly higher than where it began, underlining a still‑strong structural bullish framework, especially as ETF inflows, central bank demand, and macro risk factors supported investor interest.

Outlook

Short-Term Projections (2026)

Gold enters the remainder of 2026 in a structurally bullish phase following unprecedented price gains in 2025 and exceptional volatility in early 2026. Major financial institutions and analysts still see the metal trending higher through year‑end:

J.P. Morgan projects that gold could push toward $5,000/oz by late 2026, reflecting continued central bank demand and portfolio diversification into gold.

Goldman Sachs forecasts gold as one of the top performing commodities in 2026, with an end‑of‑year target around $4,900/oz driven by ongoing official sector buying and elevated geopolitical risk.

Some bank forecasts are even more aggressive — JPMorgan analysts have suggested gold could reach ~$6,300/oz by year‑end 2026 under sustained safe‑haven demand and central bank accumulation.

Primary Supporting Factors in 2026

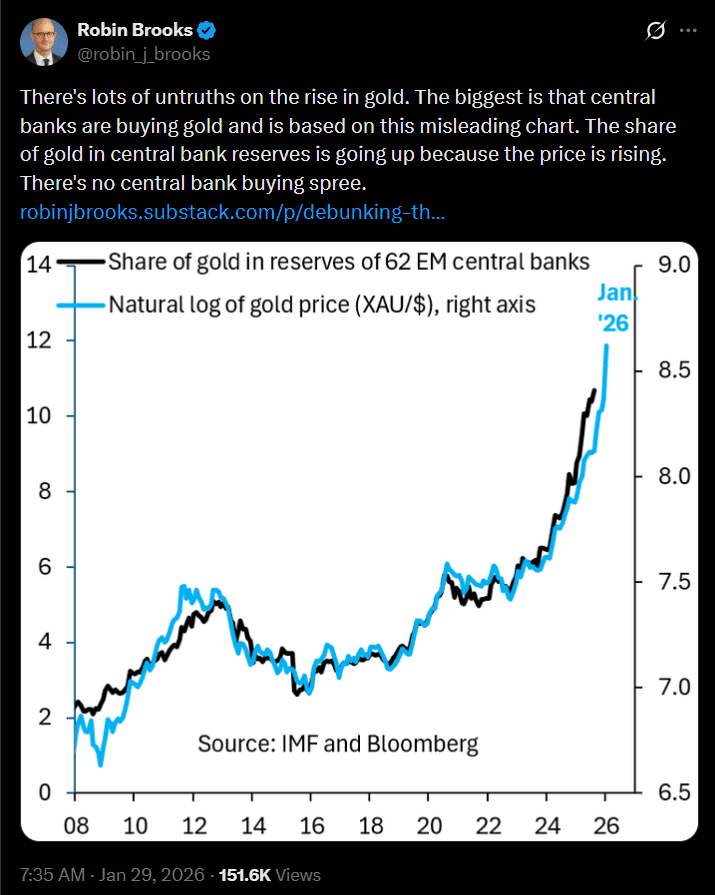

Central bank demand remains exceptionally strong, with many official institutions accumulating reserves as a hedge against inflation and currency risk.

Safe‑haven positioning continues amid persistent geopolitical tensions and monetary policy uncertainty internationally.

Monetary policy influence: Lower real yields and expectations for accommodative central bank actions support gold’s appeal as a non‑yielding asset.

Risks/Headwinds

Upside momentum can be disrupted if macroeconomic conditions shift such that real yields rise materially or the U.S. dollar strengthens.

Prolonged periods without fresh catalysts could lead to range‑bound conditions or pullbacks before any resumed advance.

Near‑Term 2026 Range Scenarios

Bullish: $5,000 – $6,300+

Base case: $4,600 – $5,000

Cautious: $4,000 – $4,500

Medium-Term Projections (2027–2030)

Looking to the end of the decade, structural drivers suggest a continuation of the long‑term uptrend, albeit with cyclical periods of consolidation and volatility:

Long‑term forecasting models and analyst compilations suggest gold could be within a higher price band by 2030, commonly ranging between $5,500 and $7,000+ per ounce depending on macro conditions.

Some extended forecast sources intriguingly point to even bigger levels, with ambitious projections over $8,000/oz by 2030 under sustained inflation and currency debasement concerns.

Key Medium‑Term Drivers

Persistent central bank accumulation: A structural shift where many emerging and developed markets increase gold holdings to hedge geopolitical and currency risks.

Inflation & real yields: If inflation expectations remain elevated or real yields turn negative, gold benefits significantly.

Safe‑haven status: Ongoing global uncertainties (trade fragmentation, geopolitical flashpoints, fiscal stress) are supportive catalysts.

Medium‑Term Risks

Stronger‑than‑expected economic growth or unexpectedly hawkish policy tightening could temper gold’s advance.

Periods of correction or consolidation within a long‑term uptrend are normal and expected.

Medium‑Term 2027–2030 Range Scenarios

Bullish: $6,000 – $8,000

Base case: $5,500 – $6,500

Cautious: $5,000 – $5,500

Long-Term Projections (Beyond 2030)

Beyond 2030, gold’s role as a strategic monetary and portfolio asset could deepen further, with structural trends that support higher nominal prices over time:

Potential Long‑Term Drivers

Monetary system evolution: Continued de‑dollarization and diversification of sovereign reserves may elevate gold’s role as a global anchor asset.

Fiscal and currency risk: Persistent large government debts and fiscal imbalances in major economies could weaken confidence in fiat currencies, strengthening demand for gold.

Supply constraints: Physical supply growth is limited relative to financial demand — mine production increases slowly and above‑ground stocks are finite.

Long‑term price forecasts incorporate wide scenarios — from moderately higher to transformational:

Moderate structural ascent: $8,000 – $10,000+ per ounce

Extended risk scenario: $10,000+ per ounce if systemic financial stress accelerates

Baseline long‑term: $7,000 – $9,000 based on continued accumulation and real yield trends

These ranges reflect deep structural drivers rather than short‑term cyclical noise.

Summary

Rest of 2026: Gold is expected to remain structurally supported and potentially trend higher, with forecasts ranging from ~$4,600 up to $6,300+ depending on macro developments. Medium term (2027–2030): Structural demand from central banks, safe‑haven flows, and real yield trends suggest a sustained uptrend, likely placing gold in a higher trading band (~$5,500 – $8,000+). Long term (beyond 2030): Gold’s fundamental role as a hedge, monetary reserve asset, and safe haven under systemic stress remains intact, potentially driving prices into the upper ranges of forecasts if macro financial stress intensifies or fiat confidence erodes. Overall, gold’s secular bull trend appears intact, with meaningful upside potential tempered by periodic corrections and macro risk repricing.

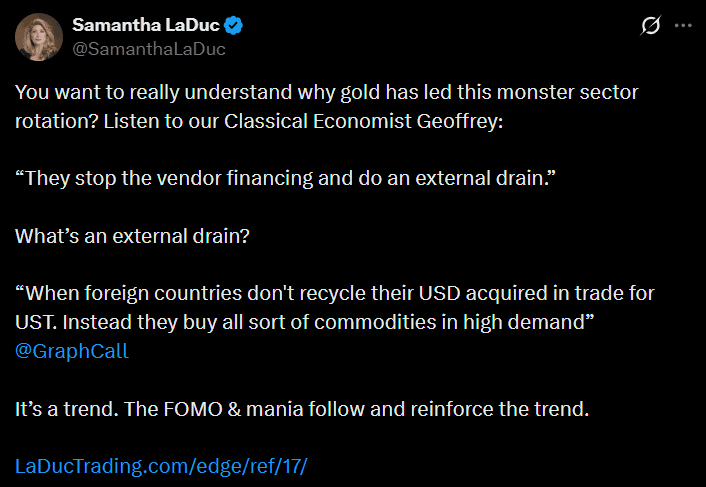

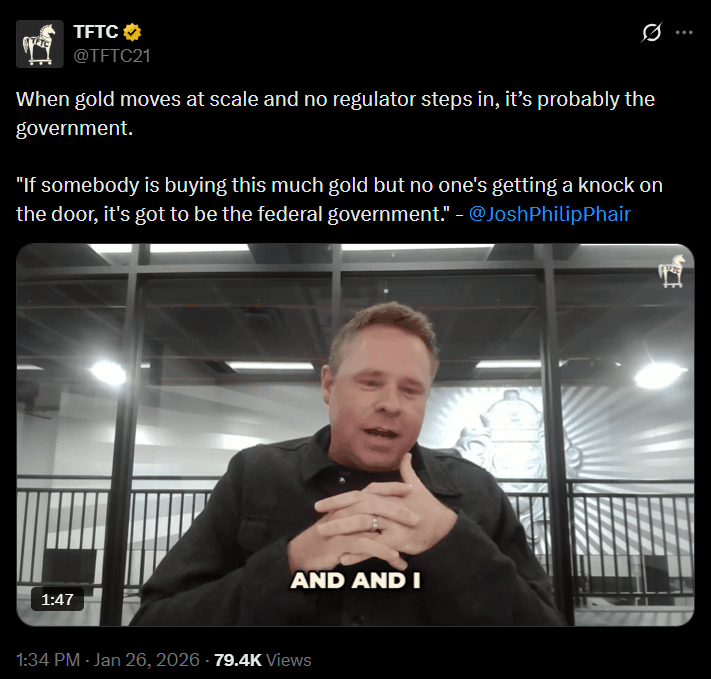

Gold on Socials

Interesting Posts on X.com

Price Performance & Forecast

Price Performance Charts:

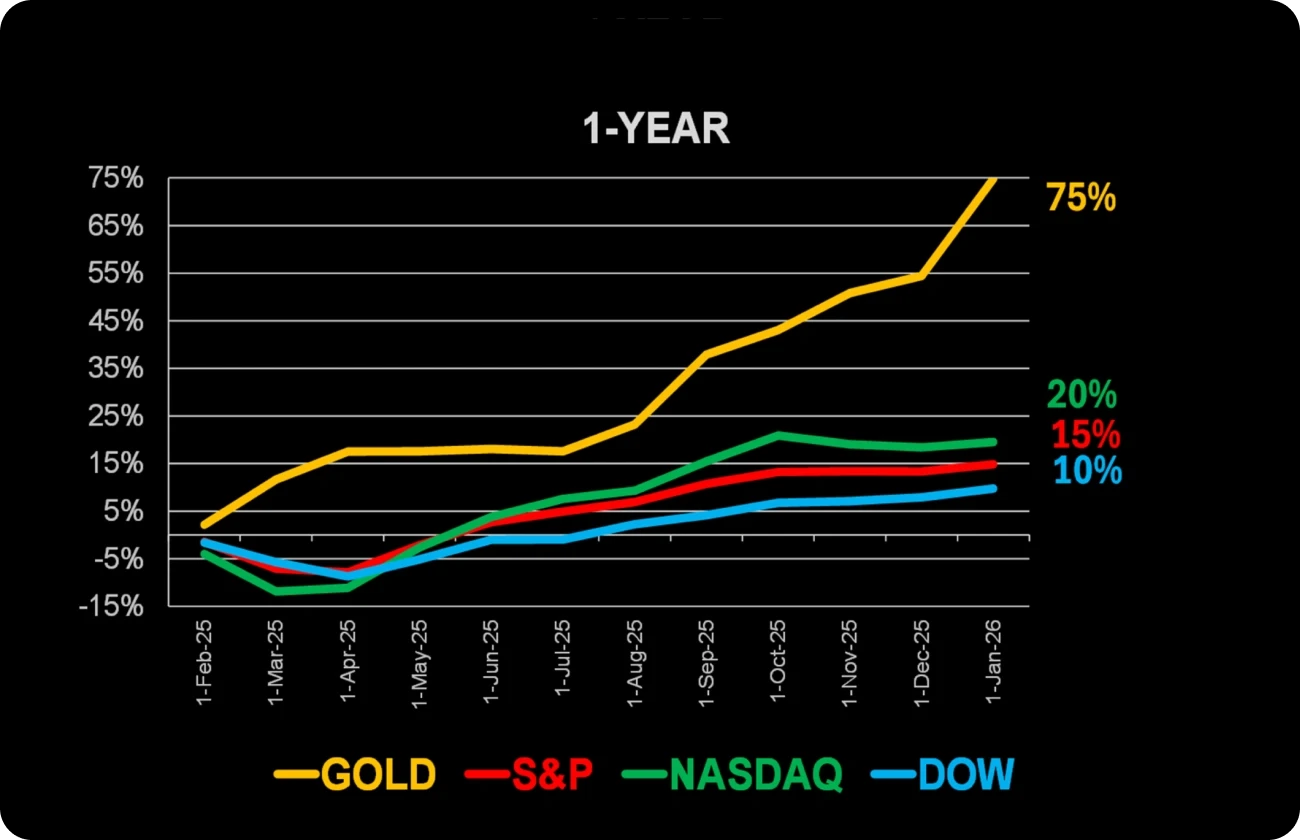

Since January 1/20, 1-Year, 3-Month, 1-Month

Gold Price vs. S&P 500 vs. Nasdaq vs. Dow Jones ending January 31, 2026

(Source: WGC, STLLR Estimates, TradingView)

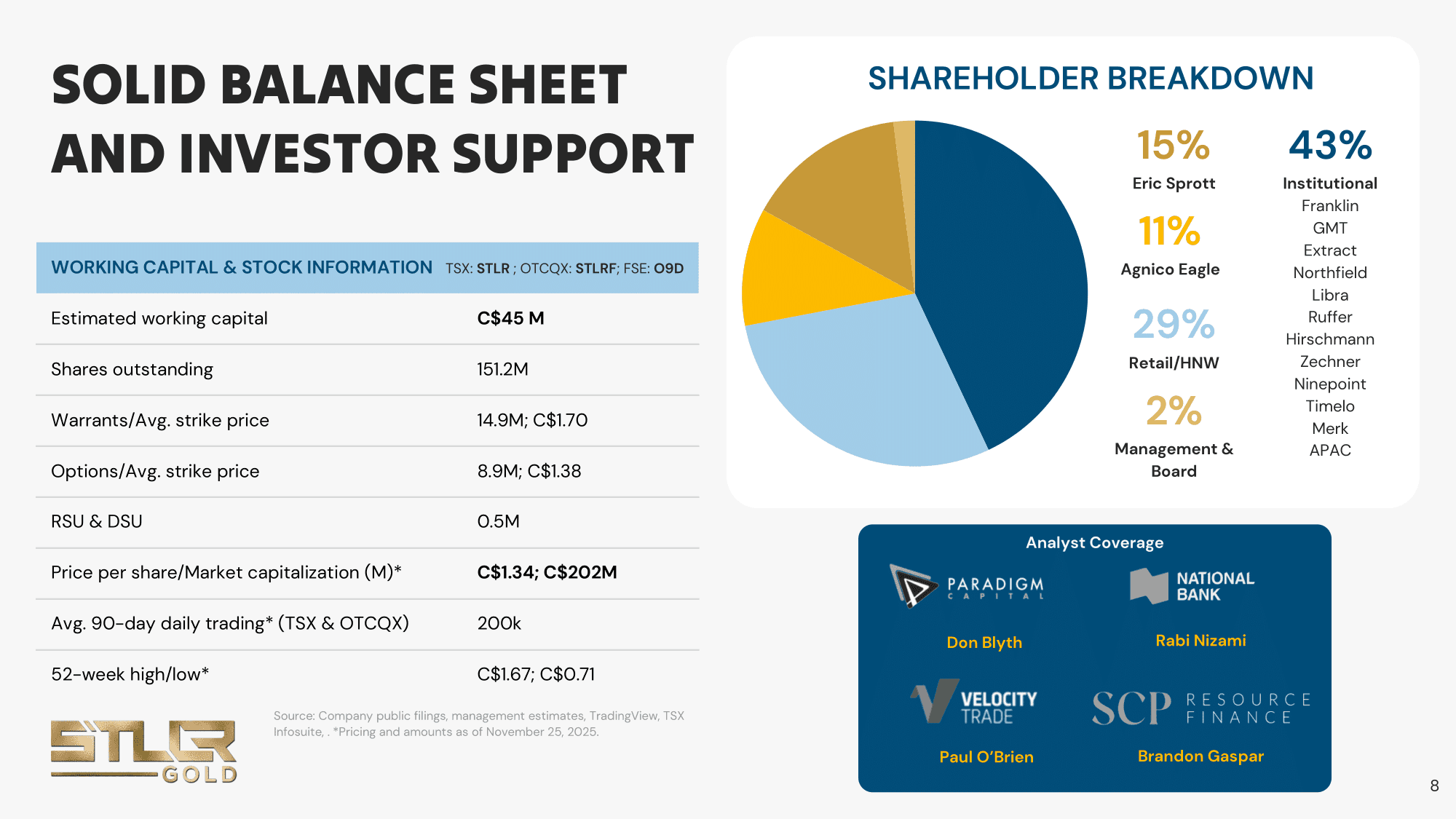

STLLR Management Share Purchases

We have Skin in the Game! |

Gold Price Performance Per Currency

Currency

Jan-26

1-Year

USD

+10.6%

+75.1%

Euro

+10.2%

+54.4%

JPY

+11.1%

+75.3%

GBR

+9.3%

+59.8%

CAD

+10.3%

+67.6%

CHF

+9.4%

+52.0%

INR

+11.0%

+85.3%

CNY

+9.3%

+67.3%

TRY

+12.1%

+113.0%

SAR

+10.6%

+75.0%

IDR

+11.5%

+81.2%

AED

+10.6%

+75.1%

THB

+9.4%

+60.0%

VND

+10.1%

+81.7%

EGP

+9.8%

+63.8%

KRW

+9.6%

+75.5%

RUB

+9.8%

+33.5%

ZAR

+6.7%

+52.2%

AUD

+8.0%

+60.7%

(Source: WGC, Goldprice.org)

The David Lin Report with Keyvan Salehi, President & CEO

December 2025

Renmark Virtual Non-Deal Roadshow with Salvatore Curcio, CFO

January 2026

OTC Markets Precious Metals & Critical Minerals Conference with Allan Candelario, VP, Investor Relations & Corporate Development

February, 2026

CONNECT WITH US

Let’s Start a Conversation

We value open communication with our investors. Connect with us through social media or reach out directly: